On August 10, 2009, the Pension Benefit Guaranty Corporation assumed responsibility for the pension plans of Delphi Corp. The plans ended as of July 31, 2009.

Delphi's six pension plans cover 70,000 workers and retirees. PBGC is paying, or will pay, pension benefits to those individuals up to limits set by federal law. In the near future, we will contact each person in the plans to let them know about the next steps.

For more general information about PBGC, please see the frequently asked questions about PBGC and the limits on its guarantees. In addition, we will continue to update the following answers to frequently asked questions from Delphi workers and retirees.

Since Delphi entered bankruptcy protection in 2005, the PBGC has worked with Delphi, GM and other stakeholders to keep all the pension plans ongoing or to have them assumed by GM. In 2008, GM did assume responsibility for a portion of the Delphi hourly pension plan, and was expected to take back the entire hourly plan. However, GM itself reorganized in bankruptcy earlier this year and now states it is unable to afford the additional financial burden of the Delphi pensions.

The process of transferring pension plans and their assets to PBGC trusteeship is administratively easier when done as of the end of the month. After review of the facts and circumstances in the Delphi case, we have determined that setting a termination date of July 31 for the Delphi plans will reduce administrative costs and ensure a smooth transition to PBGC trusteeship. The new date will not have a negative impact on any Delphi participants.

The PBGC can pay benefits only up to the legal limits.

In its news release of July 21, 2009, General Motors made the following statement about the hourly plan guarantee:

"As a result of bargaining at the time of the spin-off, General Motors Corporation did agree to top-up pension benefits for certain limited groups of hourly employees and retirees in the event that the Delphi hourly pension plan was terminated. As with other union agreements that it has assumed from the old GM, General Motors Company will honor these commitments."

Any additional benefit amounts that GM has promised to pay will come from GM. All questions about the additional guarantee should be directed to GM.

The PBGC is not aware of any agreement by GM to pay additional benefits to Delphi salaried plan retirees.

Delphi hourly plan participants who were transferred back to GM will continue to receive their benefit from the GM hourly plan. They will not be affected by the Delphi plan termination.

The PBGC can pay benefits only up to the limits set by law. Those limits are more likely to affect early retirees and those who receive supplemental benefits. Some individuals will see reduced benefits. The PBGC cannot estimate individual benefit amounts until several months after becoming trustee of the plan.

Each year PBGC uses a formula in the federal pension law, ERISA, to calculate the maximum guaranteed benefit. Since Delphi's plans were terminated July 31, 2009, their participants' maximum guarantees are based on 2009 amounts. (For plans terminating in bankruptcies that began on or after September 16, 2006, a different rule applies, but Delphi's bankruptcy began in 2005.)

If you begin receiving PBGC benefits at age 65 and have no survivor benefit, the maximum guarantee is $4,500.00 per month ($54,000.00 per year). You can find more information about other ages and types of annuity here. Here is our maximum monthly guarantee table.

If you were already receiving benefits from your Delphi plan on July 31, 2009, the maximum guaranteed benefit is based on your age on that date, and the type of annuity you receive.

Other legal limitations can affect the amount of your PBGC benefit, and for certain disability benefits there is no reduction for your age in the maximum guarantee. All the legal limitations are applied independently, so more than one limitation may apply.

Most plans, including your plan, reduce the amount of pension benefits if the participant chooses a form of annuity that provides payments to a beneficiary upon the participant's death. Your plan includes adjustment factors to convert your benefit from the straight-life annuity amount (the normal form of annuity for single participants) to a joint-and-65%-survivor annuity with a "pop-up" (the normal form of annuity for married participants). This form of annuity provides that if you die first, your spouse will receive 65% of your benefit after your death for the rest of his or her life. If your spouse dies first, your benefit will "pop-up" to the straight-life amount (i.e., the amount payable if no survivor benefit is payable after your death).

To determine whether your benefit exceeds the maximum guaranteed benefit, PBGC starts with your benefit as calculated under the terms of your plan. For this calculation, PBGC uses your plan's adjustment factors for a joint-and-65%-survivor annuity based on your age and your spouse's age at the date that you retired, the same adjustment factors your plan used to calculate your benefits.

To calculate your maximum guaranteed benefit (MGB), PBGC uses its own adjustment factors for a joint-and-65%-survivor annuity, based on your age and your spouse's age at the date you begin to receive benefits from PBGC, to convert the maximum guaranteed benefit from the straight-life annuity amount to the joint-and-65%-survivor annuity (with a "pop-up") amount. If you were already retired when your plan ended, PBGC will use your age and your spouse's age at the date of plan termination. If you retire after your plan ended, PBGC will use your age and your spouse's age at the date you retire.

PBGC then compares your plan benefit to your MGB; if your plan benefit is greater than your MGB, PBGC will not guarantee the portion of your plan benefit in excess of the maximum guaranteed benefit limit.

It will take us several months to review all the information needed to calculate our estimated benefits for the entire plan. Given the number of participants, the complexity of the plan, and our desire to give you as accurate an estimate as possible, it may be six to nine months before we adjust benefits to estimated PBGC benefit amounts.

It will take several years to fully review the plan and finally determine all benefit amounts. We will notify you in writing of your PBGC benefit determination, and your right to appeal our determination. If you are receiving an estimated benefit, the letter will inform you whether your future payments will change and if so, how much higher or lower they will be.

In general, you must be at least age 55 to begin receiving benefits from PBGC. However, if you met the plan's conditions for earlier retirement (e.g. "30 and Out" or "85 Point" retirements) before the date of plan termination, you may be able to start receiving benefits earlier.

If you already receive pension benefits from the plan, you cannot withdraw your employee contributions in a lump sum. Your benefit will continue to be paid in the form of annuity you elected when you retired.

If you do not yet receive benefits from the plan, PBGC will contact you with information on your benefit and will notify you of your opportunity to withdraw your employee contributions. You will have 60 days from that notification to elect a lump-sum distribution of your employee contributions.

Yes. If you withdraw your employee contributions in a lump sum, your maximum guaranteed benefit will be reduced by the monthly annuity amount the contributions would have provided on the date you start to receive your remaining benefits.

If you do not withdraw your employee contributions, the full amount of your annuity payments including the part attributable to the employee contributions will be limited by the maximum guaranteed benefit limit.

No. PBGC was established to insure benefits from defined benefit pension plans, and does not pay health or other retirement benefits. However, you may be eligible for the Health Coverage Tax Credit if you are age 55 or older.

In general, once you have begun to receive benefits from the plan, you cannot change your form of annuity. You will continue to receive your benefits from PBGC in the same form that you elected before the plan ended.

The normal form of benefit for a married participant for the hourly plan and for the Part A basic benefit in the salaried plan is a joint-and-65%-survivor annuity with a "pop-up." This form provides that if you die first, your spouse will receive 65% of your benefit after your death for the rest of his or her life. If your spouse dies first, your benefit will "pop-up" to the straight-life amount (i.e., the amount payable if no survivor benefit is payable after your death). PBGC guarantees this form of benefit.

Your plan also provided for other post-retirement changes. If you elected the normal form of benefit for a married participant before the plan ended, the plan would have permitted you to change your benefit to a straight-life annuity if your marriage ended in divorce and your former spouse agreed, and then to revert back to a joint-and-65%-survivor annuity if you remarried. PBGC will not allow these changes, but we will honor such changes made before the plan ended.

The normal form of benefit for an unmarried participant for the hourly plan and for the Part A basic benefit in the salaried plan is a straight-life annuity. If you were single when you retired and you elected the straight-life annuity before the plan ended, the plan would have permitted you to change your benefit to a joint-and-65%-survivor annuity if you later married. PBGC will honor any such changes you made before the plan ended, but PBGC will not allow you to make any changes to your form of benefit after your plan ended.

PBGC cannot pay you more than your plan would have provided had you retired at your normal retirement age with a straight-life annuity.

If an event such as a shutdown or lay-off occurred after July 26, 2005, the additional benefits may not be fully guaranteed. The phase-in rule described in our general FAQs would treat the additional benefits as if they were first adopted by the plan on the date of the layoff or shutdown.

If you are receiving higher benefits because of this early retirement incentive, the additional benefits may not be fully guaranteed. The phase-in rule described in our FAQs may apply.

As PBGC determines your guaranteed benefit, we also determine whether the assets available in your plan will provide benefits greater than the guaranteed benefit. These assets are allocated to benefits according to priority categories set by law.

PBGC guarantees basic benefits, regardless of the assets your plan has when PBGC takes it over. Your benefit as finally determined will not be less than the amount PBGC can guarantee.

Federal law outlines how assets from terminated pension plans are distributed, with priority given to retirees and people eligible to retire. PBGC follows specific rules to allocate pension plan assets to six priority categories (PC1 through PC6). PBGC allocates the plan's assets to benefits owed in each category, in this priority order, until all of your plan's assets are allocated, so you may receive benefits above what PBGC guarantees.

The law provides a formula for PBGC to allocate a portion of its recovery from the plan sponsor to provide benefits that are not guaranteed or funded by plan assets. Generally, in the Delphi plans, the recovery may allow PBGC to pay additional benefits in Priority Category 3.

Delphi FAQs for Benefit Impacts from PBGC Sale

While PBGC is pleased with this transaction, the dollars we will receive are less than 10% of the amount that we need to fund the benefits. PBGC doesn't know how this action will affect benefits.

Most participants will receive their full benefit because the benefit they were entitled to at the time their plan terminated was smaller than the amount that PBGC guarantees. A pension plan’s assets only come into play when the benefit you earned under the plan is larger than what PBGC guarantees. If you are receiving your full benefit, this transaction will have no effect on your benefit.2

The most likely group to be helped by the additional money is those who retired or could have retired by July 31, 2006, 3 years before the plan ended. This is because any additional monies PBGC receives will go first to these participants. However, because the amount we will receive is such a small percentage of what PBGC needs to pay benefits, any benefit increases to these participants will be very small.

FAQs Why Some Delphi Salaried Retirees Will Receive Payments From Both PBGC and Prudential

Starting June 1, about 6,000 Delphi salaried retirees will see a change in how they receive their retirement benefit. They will continue to receive the same benefit amount.

If you are one of the affected retirees, PBGC sent you a letter on April 30. The letter explains that instead of a single monthly benefit payment, you will now receive two payments each month.

You will continue to receive a monthly payment from PBGC. The amount will be lower than the payment you currently receive from us. You will also receive a second payment each month from Prudential Insurance Company of America.

Added together, the two benefit payments equal the total monthly amount you have been receiving.

The average monthly amount that Prudential will be paying is $46. Our letter tells you the specific amounts you will receive from PBGC and from Prudential.

Seventy-six former Delphi salaried workers who have not yet begun to receive their pension benefit are also affected by this change. We have sent them a letter to explain how they should apply for their benefit from PBGC and from Prudential.

After PBGC took responsibility for your Delphi pension benefit in 2009, we learned that your benefit had been funded by two separate sources. Most of your benefit was funded by Delphi. However, a small portion was funded by your employee contributions. Your pension plan used your contributions to purchase an annuity for you from an insurance company. This small annuity will now be paid by Prudential.

PBGC has been working for several years with Prudential and the other insurers involved (Aetna Life Insurance Company and Metropolitan Life Insurance Company) on this long, complex process. We now have an agreement with the insurers to have Prudential pay the annuities. We wanted to ensure a smooth transition with minimal impact on you and the other retirees.

Your annuity was purchased long before PBGC became responsible for your pension plan. It is separate from the benefit that PBGC pays. The insurance company has an irrevocable commitment to pay the annuity.

Sorry, but no. The insurers are responsible for paying the annuity. PBGC can't keep paying it.

The annuities were actually sold by all three companies. However to keep it simple, Prudential is acting as the lead administrator and will pay your annuity on behalf of the three insurers.

The annuities were purchased by General Motors before 2000. When Delphi was spun off from General Motors, the annuities were transferred to the Delphi Retirement Program for Salaried Employees, effective May 1, 2000.

We can't speak for Prudential on that issue. Please contact them at 1-800-621-1089 for an answer to your question.

No. For purposes of the limit, your total benefit continues to include the annuity amount. If your benefit was reduced because of the congressional limits, it will not change.

Yes. Since you'll be getting paid by both organizations, you will have to contact them both.

The best way to keep in touch with PBGC is through our online service, MyPBA. Or you can send us an email at MyPension@pbgc.gov. Also, you can call us Monday through Friday, 8 a.m.-7 p.m. ET at 1-800-400-7242.

Prudential's telephone number is 1-800-621-1089.

You will have to apply with both PBGC and Prudential.

The easiest way to apply for your PBGC benefit is through our secure online service, MyPBA. You should fill out your application no sooner than four months before you want to start benefits. To start receiving your annuity payment from Prudential, call 1-800-621-1089.

No, if you haven't yet retired, you can start getting your benefit from PBGC at the same time as your annuity from Prudential, or on a different date. It's up to you. Also, you don't have to choose the same form of annuity for both benefits.

Important Tax Information for participants in Delphi’s Salaried Employees Plan

Important Information

The Delphi Salaried Plan (the Plan) allowed eligible participants to make after-tax contributions from their paychecks to increase their retirement benefits. PBGC does not report the taxable amount of your annuity payments to the Internal Revenue Service, only the total or gross amount paid. If you made after-tax employee contributions to the Plan you will need to determine the portion of your PBGC monthly benefit that is considered taxable income for your 2010 Federal Income Tax Return.

Based on information we received from the plan, all of your annuity payments are taxable income. The Plan treated your employee contributions as being in a separate pension plan for tax reporting purposes. Therefore, when you withdrew your contributions, the withdrawal was treated as a total distribution of that plan’s benefit, and the entire amount of your contributions was treated as non-taxable income when they were paid to you. As a result, the Plan subsequently treated your annuity payments as provided entirely by the employer and thus as fully taxable.

The amount in Box 1, Gross distribution, of your 1099-R from PBGC for 2010 should be the taxable amount of your annuity.

If you did not withdraw your contributions, your annuity payments include a benefit provided by your employee contributions. Therefore, a portion of your annuity payments are non-taxable and you must determine the taxable amount of your annuity payments. The Plan would have computed the non-taxable and taxable amounts of your annuity payments when you retired. The non-taxable amount of your annuity payments would have first been computed as a monthly amount. This monthly amount generally remains the same, even if the amount of your payments later changed.

You should be able to determine the non-taxable and taxable amounts of your annuity payments using information from 1099-R's you received from the Plan for years before PBGC began making payments to you (1099-R's for 2009 and earlier) and information from the 1099-R that PBGC to sent you for 2010.

- Non-taxable amount of payments. To determine the monthly non-taxable amount:

- Subtract the amount in Box 2a, Taxable income, of the 1099-R from the plan, from the amount in Box 1, Gross distribution, of the 1099-R from the plan.

- Divide the difference by 12 months.

- If the amount previously reported was for more or less than 12 months of payments, you will need to divide by the actual number of months for which payment was received (for example, you retired in the middle of 2009 and only received payments for 6 months).

- Taxable amount of PBGC payments. To determine the taxable amount of your annuity payments from PBGC:

- Multiply the monthly non-taxable amount (from above) by the number of months for which you received payments in 2010. In most cases, this will be 12 months.

- Subtract that non-taxable amount from the amount in Box 1, Gross distribution, of your 1099-R for 2010 from PBGC.

- Taxable amount of future payments. The monthly non-taxable amount will remain the same, even if your payments from PBGC change. This portion of your annuity payments remains non-taxable in order to recover all your contributions tax-free. You should have received information showing the total contributions (without interest) that you should recover tax-free from the Plan when you retired.

Example

- From your 1099-R for 2009 from the Plan:

- Box 1, Gross distribution: $25,000

- Box 2a, Taxable Amount: $24,160

- The difference in Box 1 and Box 2a: $840 ($25,000 - $24,160)

- Number of months you received payments for in 2009: 12

- Monthly non-taxable amount of your annuity payments: $70 ($840 ÷ 12)

- From your 1099-R for 2010 from PBGC, Box 1, Gross distribution: $23,000

- Number of months you received payments for in 2010: 12

- Non-taxable amount of annuity payments for 2010: $840 ($70 X 12)

- Taxable amount of annuity payments for 2010: $22,160 ($23,000 - $840)

We suggest that you follow the instructions in IRS Form 1040 and its instructions (1040 Instructions) which can be found at www.irs.gov to determine the non-taxable and taxable amounts of your annuity. In addition, IRS Publication 575 Pension and Annuity Income (For use in preparing 2010 Returns) provides additional information. Both publications include information about the Simplified Method, which is used to determine the non-taxable and taxable amounts of a monthly annuity payment, and provide worksheets that can be used to compute the taxable amount of your annuity payments for 2010. You will need information from documents we have already sent to you to do this computation.

You should have already received the following documents from PBGC:

- Form(s) 1099-R for 2010 issued by PBGC’s paying agent, State Street Corporation.

You may have received more than one 1099-R from PBGC; for example, if you began receiving for your annuity payments, and withdrew your employee contributions in a single sum and/or if you received a larger back payment of your annuity payments in a single sum of $5,000 or more.

- PBGC Benefit Estimation

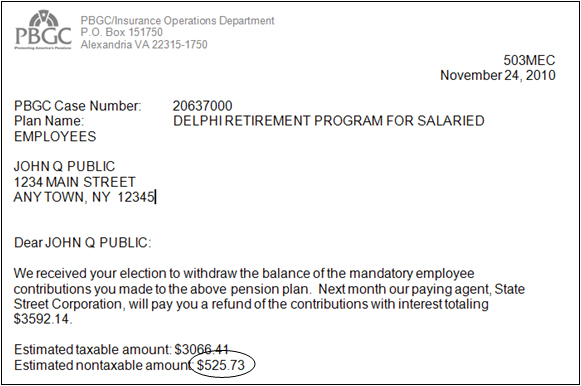

- 503MEC Letter, if you withdrew your employee contributions in a single sum from PBGC.

If you do not have these documents, please contact us for a copy.

1099-R for annuity payments.You will need the amount in Box 1, Gross distribution from the1099-R for your annuity payments.

1099-R for non-periodic payments. If you also received a 1099-R for a non-periodic or single-sum payment, for example, a withdrawal of your contributions or a large back payment of annuity payments, you will need the amount in Box 2a. Taxable amount.

Box 5. Employee contributions on the 1099-R may have an entry, which is the amount of the payment that was non-taxable. This amount should be the same as the amount shown in your 503MEC Letter as the "Estimated nontaxable amount" if you received one (see Question 3d). Let us know if these amounts are different.

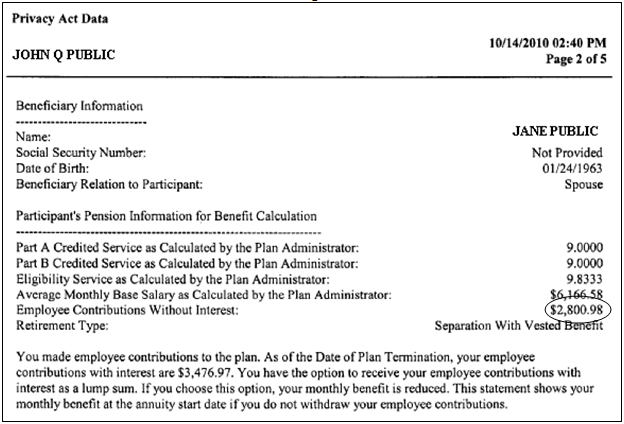

Your PBGC Benefit Estimation provides your "Employee Contributions without Interest" as of the date of plan termination, July 31, 2009. It may also contain additional information if you made any withdrawals before the plan terminated. Image A below shows where this information appears (circled):

Image A

The 503MEC Letter sent to you by PBGC provides the "Estimated nontaxable amount" of your withdrawal. This amount should be the same as the amount shown in Box 5. Employee contributions of your 1099-R for the withdrawal (see Question 3b). Let us know if these amounts are different. Image B below shows where this information appears on the 503MEC Letter (circled):

Image B

Please note that the difference between your "employee contributions with interest" shown on your PBGC Benefit Estimation and the "refund of the employee contributions with interest" on your 503MEC Letter is additional interest we paid you from the date the plan terminated, July 31, 2009, to the date your employee contributions were paid.

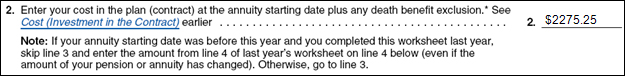

As Worksheet A suggests, you should refer to Cost (Investment in the Contract) for detailed instructions on how to determine your cost in the plan.

Generally, your cost in the plan is the difference between the actual amount of employee contributions you made minus the non-taxable amount of any contributions that you may have withdrawn before or at the time you retired. The following example refers to the PBGC Benefit Estimation (Image A) and 503MEC letter (Image B), above:

Example:

| Employee Contributions without Interest (Image A) |

Estimated non-taxable amount of withdrawal (Image B) | Net Cost in the Plan |

|---|---|---|

| $2800.98 | $525.73 | $2275.25 |

The net cost in the plan is entered on Line 2 of Worksheet A, as follows:

IRS Publication 575, Worksheet A, Simplified Method, Line 2:

Your cost in the plan is your "Employee Contributions without Interest" as of July 31, 2009, as shown in your PBGC Benefit Estimation (Image A).

PBGC realizes that tax information can be complicated and difficult to understand. Sources of additional tax information and guidance that you may find helpful, include:

- IRS Publication 575 Pension and Annuity Income (For use in preparing 2010 Returns), which can be found at www.irs.gov.

- IRS Form 1040 and its instructions (1040 Instructions), which can also be found at www.irs.gov.

- Internal Revenue ServiceThe IRS provides help for tax questions in several ways, many of them free. These are listed in IRS Publication 575 and on the IRS website at www.irs.gov.

We also suggest that you check with your own tax consultant. And of course, please do not hesitate to contact our Customer Contact Center at 1 1-800-400-7242 for help.

Delphi Plans that PBGC Insures

| Plan No. | Plan Name | EIN |

|---|---|---|

| 003 | Delphi Hourly-Rate Employees Pension Plan | 383430473 |

| 001 | Delphi Retirement Program For Salaried Employees | 383430473 |

| 002 | ASEC Manufacturing Retirement Program | 731474201 |

| 001 | Delphi Mechatronic Systems Retirement Program | 383589834 |

| 002 | Packard-Hughes Interconnect Bargaining Retirement Plan | 330595219 |

| 001 | Packard-Hughes Interconnect Non-Bargaining Retirement Plan | 330595219 |