The information about priority categories is simplified. None of the information takes precedence over legislation, regulations, or specific interpretations or rulings.

Question 1: Can two participants who are receiving the same benefit under the plan receive different amounts from PBGC?

Answer: Yes. Two participants who are receiving the same benefit under the plan may receive different benefit amounts from PBGC if, for example:

- they have different guaranteed benefit amounts because of a difference in age, marital status, or other factors, or

- one participant has benefits in Priority Category 3 (PC3) and the other does not, and plan assets provided at least some additional benefits in PC3.

Question 2: How do I know if I have benefits in PC3?

Answer: You have benefits in PC3 if you were retired, or eligible to retire, 3 years or more before the plan’s termination date except in certain bankruptcies. If your plan terminated while the employer was in a bankruptcy that started on or after September 16, 2006, you have benefits in PC3 only if you were retired, or eligible to retire, 3 years or more before the bankruptcy filing date.

Question 3: If I have benefits in PC3, will I receive more than my guaranteed benefit?

Answer: Maybe. If you have a bigger benefit in PC3 than your PBGC-guaranteed benefit, and there are enough assets in PC3 to fund more than your guaranteed benefit, then you will receive more than your guaranteed benefit.

Question 4: What amount of plan assets will go to my PC3 benefit?

Answer: The amount of plan assets going to your PC3 benefit depends on the amount of plan assets available for PC3. Most plans do not have PC1 and PC2 benefits, so in most cases all plan assets are available for PC3. However, plan assets often do not cover all of the PC3 benefits of participants.

If assets do not cover all of the PC3 benefits, the assets are allocated on a pro-rata basis. For example, if plan assets cover 60% of all PC3 benefits, the assets are allocated to 60% of your PC3 benefit. Assets allocated to your PC3 benefits go first to your guaranteed benefits in PC3, and then to any nonguaranteed benefits that you may have in PC3.

Question 5: Is there an example of how PC3 works? (Note that this a simplified example using years instead of exact dates.)

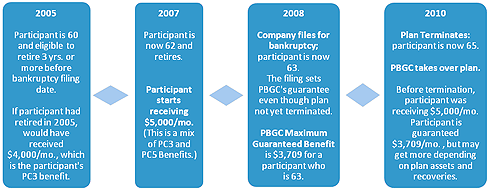

Example: My employer entered bankruptcy in late 2008 and the termination date of my plan is in 2010. (Note: PBGC’s maximum guarantee is set as of the bankruptcy filing date.) My plan was not amended to increase benefits in the five years before my employer entered bankruptcy.

I was eligible to retire in early 2005, more than three years before my employer entered bankruptcy.

If I had retired in early 2005 at age 60, I would have received a $4,000 per month early retirement benefit from my plan. However, I actually retired two years later in early 2007 at age 62 and have been receiving a benefit of $5,000 per month.

Timeline:

5(a): What is my PC3 benefit?

Answer: Your benefit in PC3 is $4,000 per month, the benefit for which you were eligible 3 years before your employer entered bankruptcy. (The bankruptcy filing date is the measuring date because the plan ended while your employer was in bankruptcy proceedings that began on or after September 16, 2006.)

5(b): How much will I receive from PBGC if plan assets going to PC3 are enough to pay my full PC3 benefit of $4,000 per month? What if plan assets do not pay all of my PC3 benefit?

Answer: PBGC will pay you your guaranteed benefit plus the amount of your additional PC3 benefit that is funded by plan assets. Your guaranteed benefit is $3,708.75 per month (see 5(c)).

- If allocated plan assets are enough to pay your full $4,000-per-month PC3 benefit, PBGC will pay you $4,000 per month, which is your guaranteed benefit of $3,708.75 plus $291.25 (the amount of your additional funded PC3 benefit).

- If allocated plan assets are enough to pay $3,900 of your PC3 benefit (more than your guaranteed benefit but less than your full PC3 benefit), PBGC will pay you $3,900 per month, which is your guaranteed benefit of $3,708.75 plus $191.25 (the amount of your additional funded PC3 benefit).

- If allocated plan assets are enough to pay half of your PC3 benefit ($2,000 per month), PBGC will pay you $3,708.75 per month, the amount of your guaranteed benefit (because there is no additional funded PC3 benefit).

5(c): What is my guaranteed benefit?

Answer: Your guaranteed benefit is $3,708.75 per month. The guarantee is determined by the date that your employer entered bankruptcy (2008) and, because you were already retired, your age at that time (age 63). The guarantee would be lower if your benefit provided for payments after your death to a beneficiary. Had your plan been amended to increase benefits in the five years before your employer entered bankruptcy, your guaranteed benefit would likely have been less.

By law, PBGC may only guarantee the lesser of your guaranteed benefit or your promised plan benefit, which was $5,000 at the time you retired in 2007. Thus, the $3,708.75 per month is your guaranteed benefit and that is the minimum amount that PBGC will pay.

5(d): What happens to the $1,000 per month ($5,000 - $4,000) that is not in PC3?

Answer: The remaining $1,000 per month of your benefit is a nonguaranteed benefit in PC5. It is not typical for a plan that PBGC takes over to have enough assets and recoveries from employers to pay significant amounts of benefits in PC5. If funds are available, PBGC divides the funds among participants’ benefits within PC5 under the asset allocation rules of the Employee Retirement Income Security Act (ERISA).