September 23, 2020 (date issued)

November 16, 2020 (date revised)

Extended Due Date for Inclusion of Prior Year Contributions

This Technical Update provides Pension Benefit Guaranty Corporation (PBGC) guidance and relief related to the timing of contribution receipts includable in the asset value used to determine variable rate premiums due in 2020. The CARES Act1 extended the due date for certain pension contributions. The relief in this Technical Update will generally enable plan sponsors to take advantage of the CARES Act extension and still ultimately pay the same variable-rate premium they would have owed had the plan received all prior year contributions by the regular contribution due date.

This relief is being provided to advance the objective of Executive Order 13924, which directs agencies to use available authority to support economic recovery, including through non-regulatory actions.

Background

PBGC’s premium rates regulation (29 CFR part 4006) provides rules for determining a plan’s unfunded vested benefits for purposes of calculating the variable-rate premium (VRP). Section 4006.4(c) requires that to determine the value of a plan’s assets for this purpose, “prior year contributions are included only to the extent received by the plan by the date the premium is filed.” The last date for a timely premium filing is the due date provided in § 4007.11(a) of PBGC’s premium payment regulation (29 CFR part 4007), e.g., October 15 for a calendar year plan.

On March 27, 2020, the CARES Act was signed into law. Section 3608(a)(1) of the CARES Act provides that any minimum required contribution that would otherwise be due under section 303(j) of the Employee Retirement Income Security Act (ERISA) during calendar year 2020 is due on January 1, 2021. The CARES Act did not provide any special rules related to PBGC premiums.

On August 6, 2020, the Internal Revenue Service (IRS) issued Notice 2020-61 Special Funding and Benefit Limitation Rules for Single-Employer Defined Benefit Plans under the CARES Act2. Q&A 4 states that the extended due date under section 3608(a) of the CARES Act also applies to contributions in excess of the amount needed to satisfy the minimum required contribution for the plan year.

Under IRS Notice 2020-82, Implementation of the CARES Act Extended January 1, 2021 Due Date for Contributions to Defined Benefit Plans, issued November 16, 2020, the IRS will consider a contribution with an extended due date of January 1, 2021, to be timely if it is made by January 4, 2021.

Using a calendar year plan to illustrate the various due dates as they relate to PBGC premium filings:

- The premium for the 2020 plan year is due October 15, 2020.

- The due date for 2019 plan year contributions was extended from September 15, 2020 to January 1, 2021.

- Absent the relief provided in this Technical Update and assuming the premium is filed on October 15, 2020, the discounted value of contributions for the 2019 plan year received by the plan3:

- On or before October 15, 2020, are included in the asset value used to determine the 2020 VRP, and

- After October 15, 2020, are not included in the asset value used to determine the 2020 VRP.

Authority for relief

Section 4002(i) of ERISA gives PBGC the authority where there is a Presidentially declared disaster (as defined in section 1033(h)(3) of the Internal Revenue Code) to prescribe relief for up to 1 year for any PBGC required or permitted actions. On March 13, 2020, President Donald J. Trump issued an emergency proclamation declaring that the Novel Coronavirus Disease (COVID-19) outbreak in the United States constitutes a national emergency, beginning March 1, 2020.

Relief

For premium filings due on or after March 1, 2020 and before January 1, 2021, the date by which prior year contributions must be received by the plan to be included in plan assets under § 4006.4(c) of PBGC’s premium rates regulation is extended to January 4, 2021.

Because of this relief, the discounted value of a “prior year contribution” received after the premium is filed and on or before January 4, 2021, may be included in the asset value used to determine the variable-rate premium.4 Thus, if such a contribution is made, the premium filing may be amended to revise the originally reported asset value and resulting variable-rate premium.

This relief has no effect on premium due dates (e.g., for calendar year plans, the 2020 premium is due October 15, 2020) and does not permit a premium filing to reflect a contribution that has not yet been made.

Instructions to obtain relief

Plan administrators that want to take advantage of this relief must amend their premium filing by February 1, 2021, to revise the variable-rate premium data accordingly after eligible prior year contributions are received by the plan.

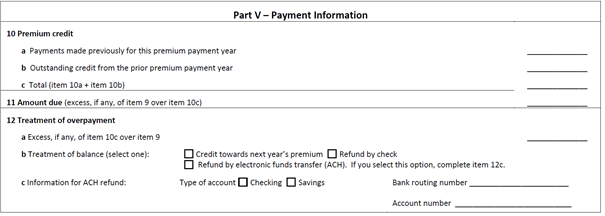

Once the amended filing is received, processed, and reviewed, the excess of the original premium paid over the revised premium will be refunded or credited to the plan’s My PAA account (whichever option the plan administrator chooses). See Part V of the illustrative premium form (shown below) and refer to the Comprehensive Premium Filing instructions for more information on amended filings.

In addition, plan administrators must include an explanation in the space provided as to why the premium amount reported in the amended premium filing is less than the amount reported in the original premium filing (item 19(c) of the illustrative form), enter “PBGC TU-20-2,” and report the date(s) and amounts of contributions included in the revised asset value that were not included in the asset value reported in the original filing.

Contact and Other Information

If you have any questions about this Technical Update, contact Amy Viener by phone at 202-229-3919 or by email at Viener.Amy@pbgc.gov.

Technical Update 20-02 revises guidance issued July 20, 2020, “COVID-19-Related Single-Employer Plan Sponsors and Administrators Questions and Answers” (PBGC Web 016).

[1] The Coronavirus Aid, Relief, and Economic Security Act, Pub. L. No. 116-136.

[2] 2020-35 I.R.B. 468.

[3] This illustration assumes that the plan is not a small plan that uses the lookback rule.

[4] For purposes of this relief, such a contribution is discounted in the same manner and using the same interest rates as required for funding purposes.