4010 Financial Information Reporting Waiver

This Technical Update 19-1 provides Pension Benefit Guaranty Corporation ("PBGC") guidance on compliance with the annual financial and actuarial information reporting requirements under Section 4010 of ERISA and part 4010 of PBGC's regulations.

This Technical Update waives the requirement (subject to certain conditions) to report member specific financial information under 29 CFR 4010.9(b)(2).

Background

Section 4010 of ERISA requires certain underfunded plans to report identifying, financial and actuarial information to PBGC. PBGC's 4010 regulation describes when a filing is required and the information to be reported in the filing.

Section 4010.9 of the regulation sets forth the reporting requirements with respect to financial information to be included with a 4010 filing for each member of the filer’s controlled group (excluding exempt entities). In general, financial statements for the fiscal year ending within the information year (including balance sheets, income statements, cash flow statements, and notes to the financial statements) must be provided for each non-exempt controlled group member.

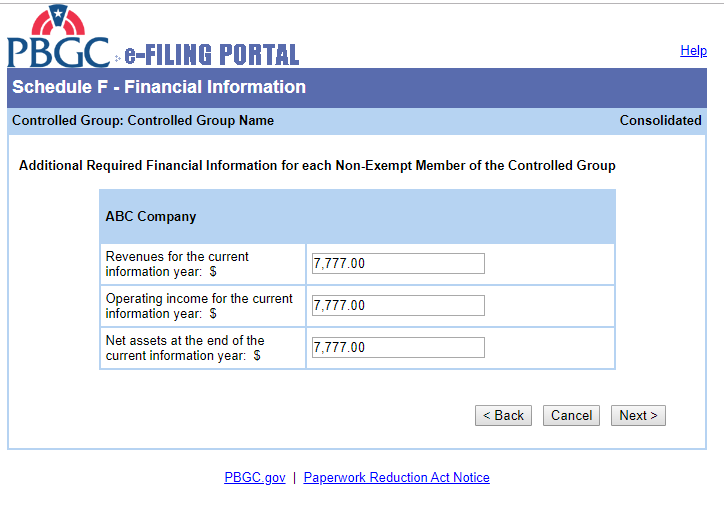

If the financial information of a non-exempt member is combined with the information of other members in consolidated financial statements, in lieu of the information noted above, a filer may submit consolidated financial statements as an attachment to the filing.[1] However, if consolidated financial statements are provided, the filer must also report revenues, operating income, and net assets separately for each non-exempt member (see § 4010.9(b)(2)). This is accomplished by manually entering those three amounts into the 4010 module of PBGC’s e filing portal for every non-exempt member of the filer’s controlled group.

On June 27, 2019, PBGC published a proposed rulemaking, “Miscellaneous Corrections, Clarifications, and Improvements” (84 FR 30666), that would eliminate the § 4010.9(b)(2) requirement to report the member-specific financial information. PBGC proposed to remove this requirement because it believes it can adequately assess risks to participants and plans without this additional detail. PBGC’s proposed rule is pending.

Waiver

Section 4010.11(d) gives PBGC the authority to waive requirements to submit information with respect to one or more filers or plans. Under that authority, PBGC is waiving the requirement in § 4010.9(b)(2) to provide member-specific financial information for filers whose ultimate parent is not a foreign entity. For filers whose ultimate parent[2] is a foreign entity, the requirement to report § 4010.9(b)(2) information is waived if filers provide consolidated financial statements for U.S. controlled group members as an attachment to their filing (or federal tax returns if consolidated financial statements are not available), in addition to any other financial information required to be included with the filing.

E-filing Portal

For filings where financial information is consolidated, the e-4010 module of PBGC’s e-filing portal considers the member-specific financial information required (i.e., submission is blocked if those fields are left blank). PBGC is providing the following work-around for filers who choose not to report the § 4010.9(b)(2) data: Instead of entering the actual revenues, operating income, and net assets in the space provided for each data item, enter $7,777. The screen shot below shows how this would appear.

Other Effect

This Technical Update supplements the guidance provided in the instructions to the e-4010 module of PBGC’s e-filing portal. It has no effect on any other requirement under 29 CFR part 4010.

Non-binding Guidance

This Technical Update does not create or confer any rights for or on any person or operate to bind the public. Following the procedures in this Technical Update are a voluntary means for otherwise satisfying the requirements of the applicable statute and regulations.

Contact Information

If you have any questions about this reporting relief, contact Ellen Itkin of the Negotiations and Restructuring Actuarial Division at 202-229-3075 or send an email to ERISA.4010@pbgc.gov.

[1]Alternatively, if the consolidated financial statements are publicly available, instead of attaching them to the filing, the filer provides information about where they can be found.

[2]“Ultimate parent” means the parent at the highest level in the chain of corporations and/or other organizations constituting a parent-subsidiary controlled group.