The Multiemployer Pension Reform Act of 2014 (MPRA) increased premiums plans pay to PBGC and allowed some plans that are projected to run out of money within 20 years to apply to reduce benefit amounts and/or ask for early financial assistance from PBGC. (PBGC typically provides financial assistance after plans run out of money, so that plans can continue to pay benefits at the level of PBGC guarantees.) The Act requires PBGC to report to Congress on whether current premium levels are sufficient to meet average expected financial assistance obligations. If premiums are not enough, PBGC is to provide a schedule of revised premiums sufficient to meet (but not exceed) such obligations.

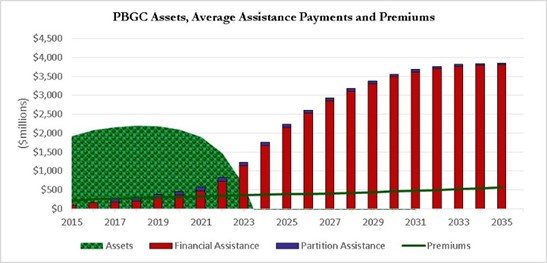

The MPRA Report shows that the current level of premiums don’t provide PBGC the ability to pay expected levels of financial assistance for the next ten years. Assuming average expected levels of financial assistance, PBGC’s multiemployer program fund is drained during 2024.

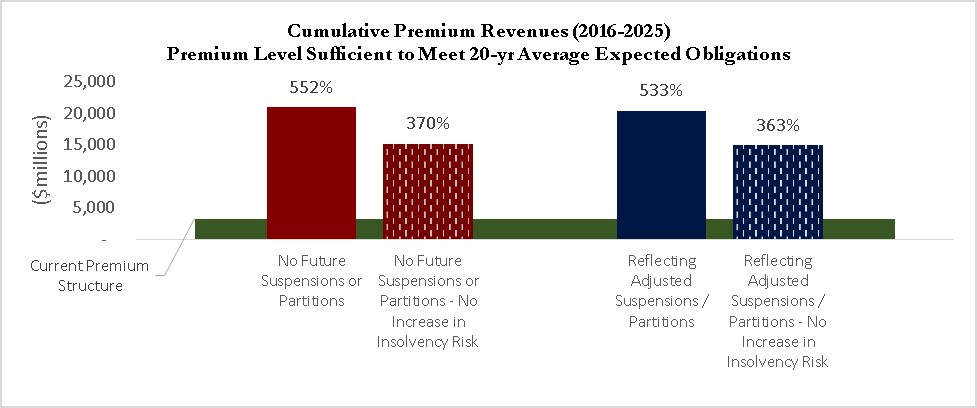

In order to pay average expected levels of financial assistance through 2035, premiums would need to rise substantially. The amount of premium revenue needed to pay average projected obligations varies depending on the degree to which plans adopt suspensions and partitions, and the extent to which premiums are not paid out of existing plan assets or can otherwise be carefully assessed so as to avoid accelerating the insolvency of troubled plans. The range of potential increases is wide, ranging from 285 percent to 533 percent for 20 year solvency.

The report also summarizes PBGC’s multiemployer guarantee structure, the history of PBGC multiemployer premiums and financial assistance, and the amount of premium required in order to provide solvency of PBGC’s multiemployer fund for 10-year periods.

To read the report click here. To read the transmittal letter click here.

The MPRA Report also summarizes PBGC’s multiemployer guarantee structure, the history of PBGC multiemployer premiums and financial assistance, and the amount of premium required in order to provide solvency of PBGC’s multiemployer fund for 10-year periods.

The Pension Insurance Modeling System (PIMS) is the modeling system that PBGC uses to estimate the future of the single-employer and multiemployer PBGC programs. It is also used to model the U.S. private pension system.